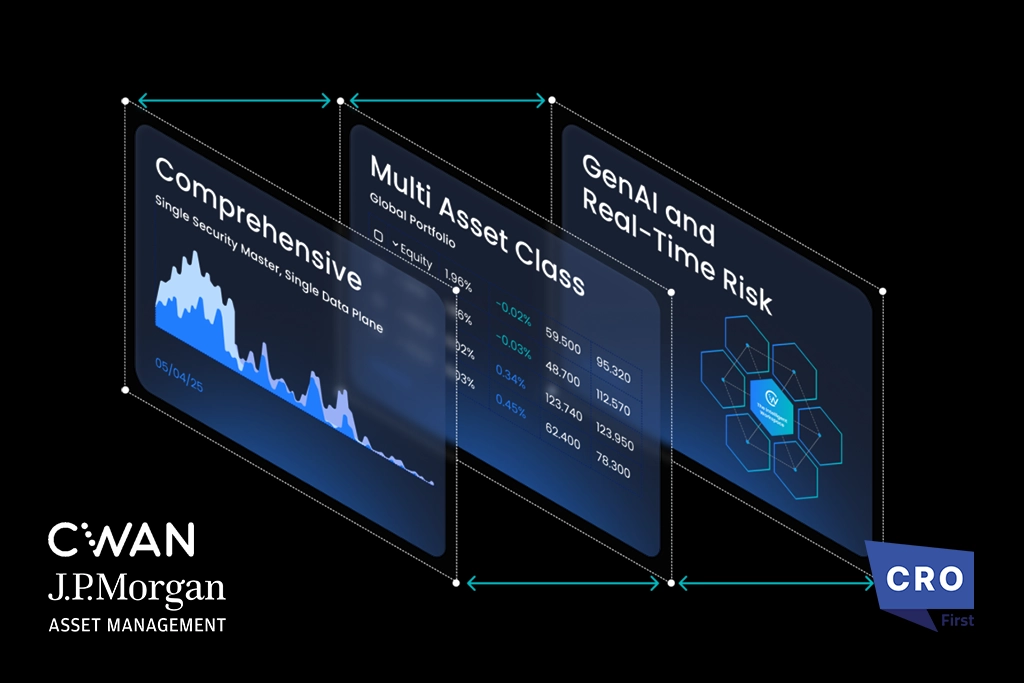

Clearwater Analytics and J.P. Morgan Asset Management announced a strategic integration that promises to transform how hedge funds manage what many have regarded as “idle” cash. The collaboration links Clearwater’s Enfusion platform directly to J.P. Morgan’s Morgan Money® short-term investment solution, delivering a unified, automated workflow to maximize yield, control liquidity and reduce operational burdens.

What the solution does

The new offering effectively turns cash from a passive holding into an actively managed asset. Through the integration:

Funds can automatically invest idle cash into a diversified range of money-market funds, moving beyond the traditional “keep it safe in one account” approach.

Concentration risk is reduced by spreading investments across multiple managers, custodians and currencies.

Real-time visibility into liquidity positions is enabled, with automated withdrawal and deposit capabilities, which helps treasury and fund-operations teams shift focus from manually moving cash to strategic decisions.

Manual treasury work is eliminated or significantly reduced, freeing up teams to concentrate on trading, strategy and fund performance rather than back-office drudgery.

Scott Erickson, CWAN’s Chief Revenue Officer, summarised the offering’s value:

“Every dollar sitting in a single account represents both a missed opportunity and unnecessary concentration risk. Together with J.P. Morgan Asset Management, we’ve built a system that makes cash an active, automated asset… helping hedge funds capture more yield, strengthen governance, and simplify operations.”

Paul Przybylski, Global Head of Product Strategy at Morgan Money, added that the partnership offers “institutional-grade solutions that simplify complexity” and provides hedge funds “a straightforward way to enhance yield, diversification and liquidity oversight—without adding operational burden.”

What are Implications for the Revenue Industry

For the broader revenue ecosystem across asset management, financial services and fintech, this launch signals several meaningful shifts:

Enhanced revenue capture from “non-traditional” assets: Cash has often been overlooked in the revenue calculations of hedge funds and asset managers. With automated management treating cash as an earn-yield asset, firms can extract incremental revenue that was previously latent.

Cost and efficiency gains: Automating treasury functions and cash-deployment workflows can reduce operational overhead, errors, and latency. The savings in time and manual effort translate into improved margin management and, in turn, higher net returns for firms.

Stronger partner/technology-ecosystem monetisation: Platforms like Enfusion and Morgan Money are becoming revenue-drivers themselves. The integration shows how software vendors can capture value by enabling clients to monetise their internal assets (e.g., idle cash). This opens new revenue lines through SaaS models, transaction fees or asset-under-management-linked pricing.

Improved risk and governance controls: For revenue leaders, better visibility into cash flows, diversifications and liquidity positions means improved compliance, oversight and decision-making. This matters to institutional investors increasingly demanding transparency and control, which in turn makes funds more “investable.”

Also Read: Sovos Launches OptiTax Solution to Transform Use Tax Compliance Management

How will it Broadly Impact on Businesses

Beyond hedge funds, the ripple effects of this innovation are significant:

Scalability of operations: Automation means firms of varying size can operate with streamlined treasury architecture, which levels the playing field. Smaller funds can adopt best-in-class workflows, reducing operational disadvantages.

Competitive Advantage: Funds using this technology can turn cash from a performance drag into a source of returns. This leads to better pitches to investors, improved metrics, and stronger brand positioning.

Data-Driven Decision-Making: Real-time dashboards and analytics help firms understand cash behavior across custodians, currencies, and instruments. This supports dynamic strategic decisions and can influence product design, fee structures, and investor communication.

Shifting Business Models: As cash management becomes tech-driven, traditional hedge fund models may shift to leaner, tech-first treasury and operations structures. This could result in cost re-engineering and increased profitability.

Conclusion

The partnership between Clearwater Analytics and J.P. Morgan Asset Management changes how cash is seen in asset management and hedge funds. Automating workflows, diversifying assets, and turning idle cash into managed yield realigns revenue, costs, and efficiency. This launch shows that untapped assets like cash can be monetized with technology. For businesses, the message is clear: treat all assets strategically, embed automation early, and use data to turn passive assets into performance drivers.